Let’s talk about that 3% number

Well, it seems like transaction info is something people are more interested in than I expected, so I wanted to tackle one more thing. So often in App Store discussions, we talk about Apple’s 30% cut of each in-app purchase on iPhones and how that’s so much higher than the “3% merchants pay” when a customer checks out from their website. The problem with this 3% number isn’t that it’s wrong, it’s just that it’s only part of the story.

Interchange plus pricing

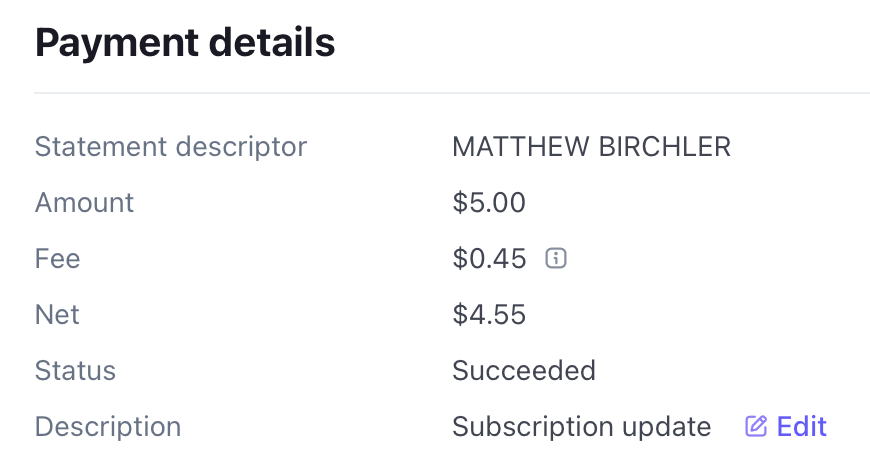

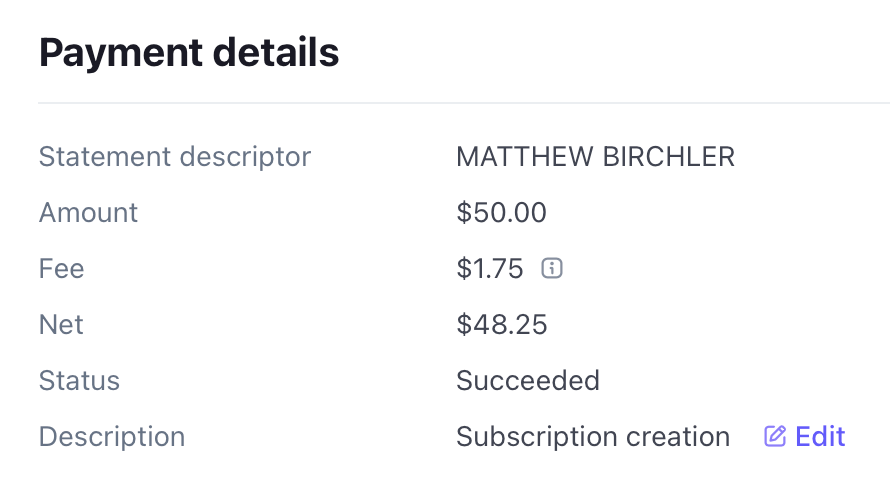

We all know Stripe, right? Well here’s Stripe’s page explaining their pricing for merchants processing payments through them. The general concept here is called “interchange plus” and it usually means charging the interchange fee (around 3%) as well as a fixed fee for each sale. That’s conveniently what I have for memberships on this site, so I can show you how much I’m paying to Stripe for each transaction. Here’s a subscription that renewed today:

That’s 9% of the sale going to Stripe.

Cutting in here to say that the way Stripe is structured, they are taking 45¢ from this transaction, but they don’t get to keep all of it. Visa, the customer’s bank, and numerous other parties in the transaction flow will get their cut as well. Apple does a similar thing with their 15-30% cut, although the way they do payments is so monumentally different than buying from a single merchant that it’s a whole separate thing. This isn’t super important to the merchant, but I thought it was worth mentioning.

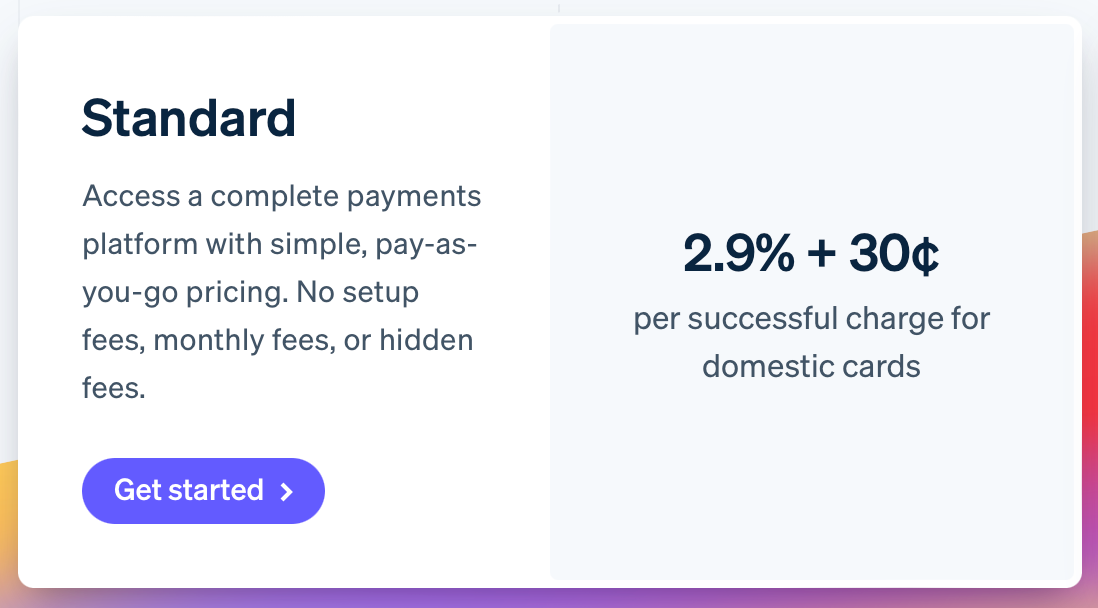

So my pricing with Stripe is their standard pricing, so 30¢ for every single transaction plus 2.9% of the total amount.

So basically:

- The customer pays $5.00

- A 30¢ flat fee goes to Stripe

- 2.9% is 15¢ which also goes to Stripe

- I take home $4.55

For comparison, as a small business on the App Store, I would lose 15%, so my take home would be $4.25. It’s less in my pocket, but we’re at least in the same ballpark.

Now, mathematically-minded readers may already have guessed that with this model, the higher your ticket amounts the better a deal it is, and that’s very true. As such, my annual subscribers are actually a better deal for me (and them, sign up here 😉). Here’s an annual sub where that 30¢ flat fee is doing less damage, reducing Stripe’s cut to just 3.5%.

If you see very expensive items, say $1,000 average ticket, then your fees will $29.30 per transaction, slightly under the fabled 3% number. Consider that compared to the App Store’s flat rate in which case your fee is 5x at $150 if you’re a small business and is 10x ($300!) if you aren’t that small.

On the other hand, if you sell a $1 item, then that 30¢ flat fee is way more impactful; Stripe will be taking 33% of your sales in that case. Oof!

Basically, with this pricing you need an average ticket of approximately $3 or more to always come out ahead compared to the App Store’s small business pricing, and you can get to that fabled “merchant pay 3%” number at around a $300 average ticket.

So yeah, it ranges quite a bit, and we haven’t even scrolled down that pricing page to see the many asterisks that slightly raise or lower the fees based on a host of variables.

Oh, and these fees get higher as well. When you pay through PayPal, the standard fees there are a fixed 49¢ plus 3.49% per transaction. That would be 15% of my $5 per month subscriptions, so within spitting distance of double Stripe’s take! I suspect PayPal would justify this difference by saying people trust the PayPal checkout flow and you’ll get higher conversion rates using us.

Tip of the iceberg

This is really the tip of the iceberg when it comes to pricing, and there are plenty of other models and countless special deals out there. For example, some merchants will have slightly different percentage fees from credit to debit, Visa to American Express, and basic to rewards cards. They also may have a monthly fee or fees to add more features onto their payment gateway account. They may have another service provider who’s taking a cut of transactions as well for their services (Gumroad takes 10% of my sales in addition to the fees Stripe is already taking).

So yeah, don’t let this be the final word on how transaction fees work – check the pricing page for whatever you’re thinking of using. My point here is mostly to explain how the 3% number is well-meaning, but is not a perfect comparison to the 15% and 30% numbers we talk about with the App Store; there's just a bit more nuance.